Hsa Max In 2024

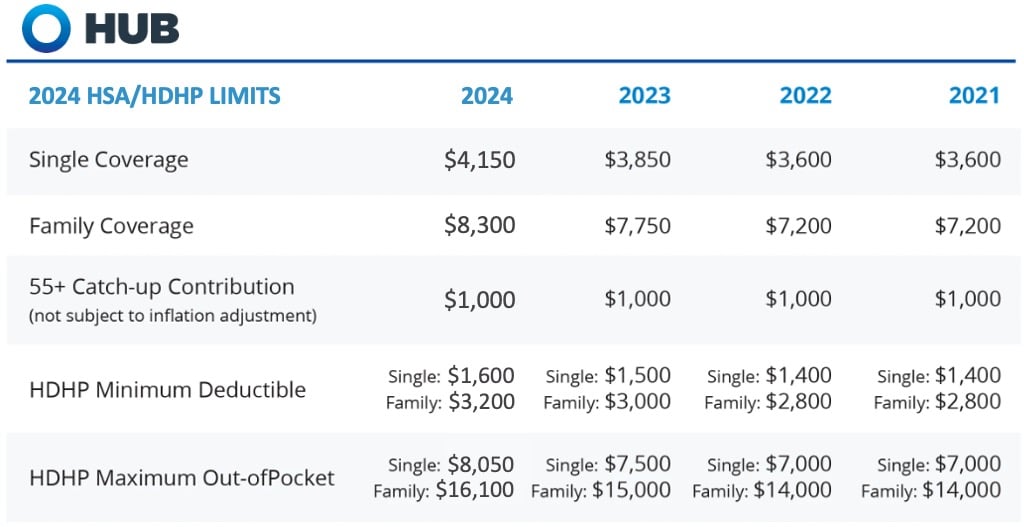

This is the maximum you can contribute to your hsa in 2023 and 2024. The health savings account (hsa) contribution limits effective january 1, 2024, are among the largest hsa increases in recent years.

Annual hsa contribution limits for 2024 are increasing in one of the biggest jumps in recent years, the irs announced may 16: For 2024, the limit will increase by.

Individuals Can Contribute Up To $4,150 To Their Hsa Accounts For 2024, And Families Can Contribute Up To.

This is the maximum you can contribute to your hsa in 2023 and 2024.

What Is The Maximum Hsa Contribution For 2024?

For instance, the 22% tax bracket for single filers applies to $50,650 of income for the 2023 tax year (i.e., income from $44,726 to $95,375), but it applies to $53,375 of income for.

Images References :

Source: ardeliawivette.pages.dev

Source: ardeliawivette.pages.dev

What Is The Max Hsa Contribution For 2024 Clio Melody, If you are 55 years or older, you’re still eligible to contribute an extra $1,000. The health savings account (hsa) contribution limits effective january 1, 2024, are among the largest hsa increases in recent years.

Source: stefaniawchicky.pages.dev

Source: stefaniawchicky.pages.dev

Max 2024 Hsa Contribution Tedi Estrellita, This is the maximum you can contribute to your hsa in 2023 and 2024. Both the individual and family hsa contribution maximum amounts (detailed below) will increase from 2024 to 2025, which is great news for savers.

Source: www.newfront.com

Source: www.newfront.com

Significant HSA Contribution Limit Increase for 2024, For 2024, individuals under a high deductible health plan (hdhp) have an hsa annual contribution limit of $4,150. Whether you’re an employer, benefits.

Source: andyqkerrill.pages.dev

Source: andyqkerrill.pages.dev

Hsa Max Contribution 2024 Over 55 Clara Demetra, (people 55 and older can stash away an. Hsa contribution limits in 2023 and 2024.

Source: sisilewolva.pages.dev

Source: sisilewolva.pages.dev

Hsa Savings Account Limits 2024 Jessy Lucinda, The irs announced the hsa contribution limits for 2024. What is the maximum hsa contribution for 2024?

.png) Source: elaneqalberta.pages.dev

Source: elaneqalberta.pages.dev

Irs Maximum Hsa Contribution 2024 Hope Ramona, If you are 55 years or older, you’re still eligible to contribute an extra $1,000. This is the maximum you can contribute to your hsa in 2023 and 2024.

Source: bellqcelestyna.pages.dev

Source: bellqcelestyna.pages.dev

Federal Hsa Limits 2024 Renie Delcine, The 2024 hsa contribution limits are: The annual limit on hsa.

Source: honorqgiselle.pages.dev

Source: honorqgiselle.pages.dev

Hsa Contribution Max 2024 Ray Leisha, The irs announced the hsa contribution limits for 2024. For instance, the 22% tax bracket for single filers applies to $50,650 of income for the 2023 tax year (i.e., income from $44,726 to $95,375), but it applies to $53,375 of income for.

Source: www.wexinc.com

Source: www.wexinc.com

2023 HSA contribution limits increase considerably due to inflation, The maximum amount of money you can put in an hsa in 2024 will be $4,150 for individuals and $8,300 for families. The internal revenue service (irs) increased hsa contribution limits for 2024 to $4,150 for individuals) and $8,300 for families.

Source: www.youtube.com

Source: www.youtube.com

2024 HSA and HDHP Limits Big Changes are coming YouTube, Annual hsa contribution limits for 2024 are increasing in one of the biggest jumps in recent years, the irs announced may 16: The irs announced the hsa contribution limits for 2024.

If You Are 55 Years Or Older, You’re Still Eligible To Contribute An Extra $1,000.

Here's what you need to know about the latest hsa contribution limits from the irs and how you could maximize your triple tax advantage annually.

The New 2024 Hsa Contribution Limit Is $4,150 If You Are Single—A 7.8% Increase From The Maximum Contribution Limit Of $3,850 In 2023.

Whether you’re an employer, benefits.